About Wyden

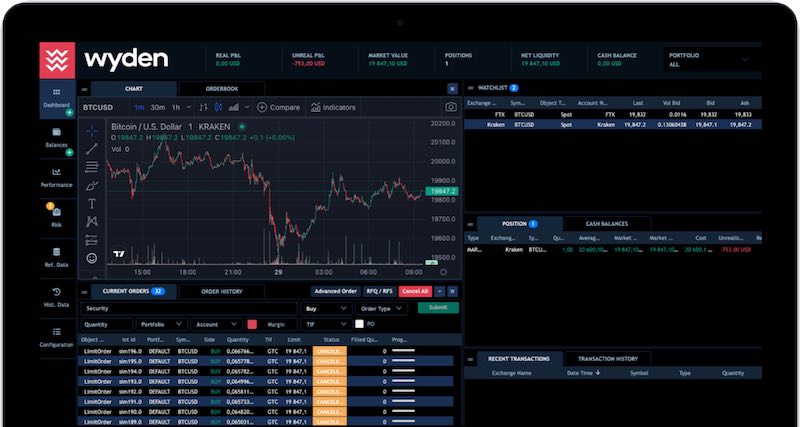

Wyden is the global leader in institutional digital asset trading technology. By covering the entire trade lifecycle and supporting seamless custody, core banking, and portfolio management system integration as well as full trade lifecycle automation, the Wyden platform streamlines digital assets trading. Engineered by a team of trading system veterans and crypto asset experts, Wyden offers best-in-class integrated infrastructure solutions that meet the highest institutional needs. Wyden has offices in Zurich, New York, and Singapore.

To learn more visit www.wyden.io.