BlockFills’ believes in the importance of bridging the gap between traditional finance and the world of digital assets. This belief is the main driver in our decision to expand and enhance our SaaS suite, which is designed to enable institutional clients to not only access BlockFills’ cryptocurrency liquidity, but also launch and scale their own digital asset business in a market where speed, security, and reliability are all critical to success.

As the industry continues to swiftly evolve, the current institutional SaaS offerings remain largely underwhelming, or at the very least, untested. Enter: BlockFills’ robust tech suite – the identical platform BlockFills has been utilizing to manage its own large-scale digital asset business.

To experience our platforms for yourself, visit our Tourial, or reach out to our team for a demo: Contact Us.

The crypto market has had a busy 2024 so far; the highly anticipated spot BTC ETF was approved in early January, new Bitcoin all-time highs were hit in March, the impending fourth bitcoin halving is expected in mid-April, and there has been movement on discussions surrounding a spot ETH ETF. With added volatility and fast-moving markets, it’s an exciting time to be a part of crypto.

With the likes of BlackRock, Fidelity, Franklin Templeton, and other highly respected financial institutions entering the space via the ETF market, the demand for institutional participation in crypto has become increasingly clear. Institutional investors in the crypto market are transforming the industry, with a heavy focus on compliance and AML/KYC and the need for custodians, banking, liquidity providers, and proper trading counterparties. Implementing and refining these protocols and services legitimizes the industry, making it more responsible and conscientious.

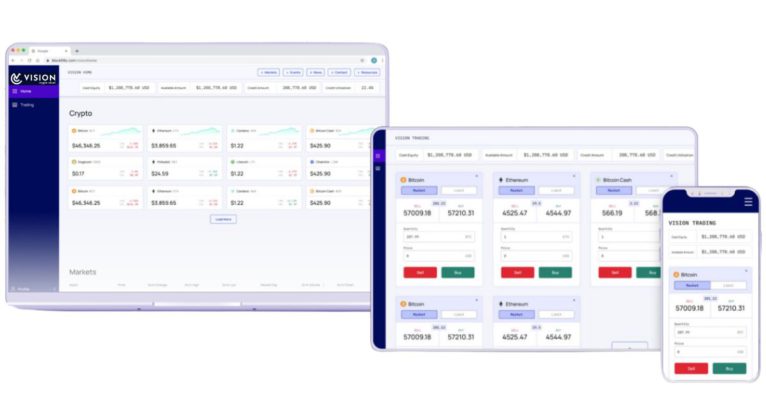

If you’ve traded on mature front-ends like those available to “Tradfi traders” in the equities, futures, and FX markets, Phoenix is for you. Walk through the platform at your own pace via our Tourial, or connect with a team member for a demo.

Phoenix remains the industry-leading mechanism for institutional clients to access BlockFills’ unrivaled digital asset liquidity. There are no monthly costs or trade minimums. Trade anytime, anywhere, on any device, 24/7 with Phoenix. Phoenix provides a modern, sophisticated trading experience paired with deep liquidity in spot and perpetual swaps* (for qualified clients).

“Phoenix is the future of institutional digital asset investing. By giving institutions access to the most advanced crypto platform available, Phoenix allows active traders to trade securely, efficiently, and confidently” says Nick Hammer, CEO of BlockFills. “BlockFills is acutely aware of the lack of sophisticated trading infrastructure required by experienced traders familiar with the platforms used in tradfi. Paired with an overarching theme of platform downtimes, subpar service, inadequate pricing, and generally poor tech design seen in crypto native platforms, our team was compelled to offer a solution such as Phoenix.”

With Phoenix, traders have access to capabilities such as:

Compatibility: Desktop, web, and mobile-friendly platform versions for 24/7 trading on any device, anywhere

Customization: Virtually limitless choices of indicators, drawing tools, and a completely customizable user-interface

Advanced Studies: VWAP, volume profile, order flow, real-time market cap, correlation matrices, heatmaps, and more

Chart-Based Trading: On-chart trading and advanced trading capabilities such as server-side OCO commands

Advanced Analytics: Real-time on-chain network data such as difficulty and hash rate, analytics, and detailed data exporting

24/7, Continuous Liquidity: Deep liquidity supported by battle-tested infrastructure

Client-Centered Service: Bespoke, white glove technical services

“Already, hedge funds, asset managers, proprietary trading groups, brokers, and other corporations have realized the power of Phoenix, and for any institutions looking to make cryptocurrency investments or manage digital assets for the first time, Phoenix is available” added Hammer.

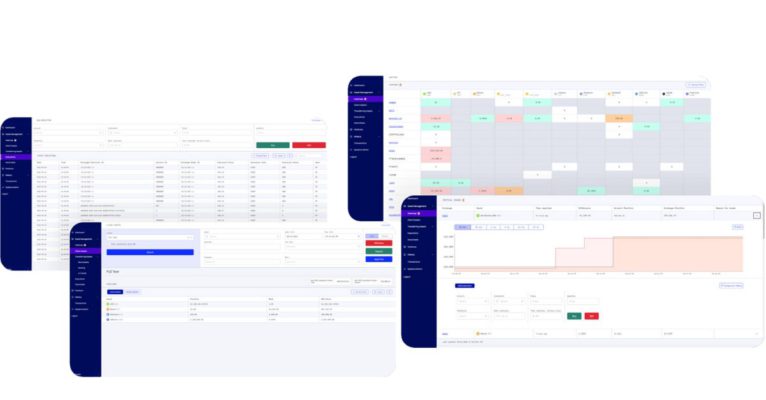

In addition to Phoenix, BlockFills offers the secure digital assets trading, order management, and risk management system, Vision Crypto Cloud. The BlockFills-created solution includes Vision Trader and Vision Core OMS, enabling institutions to quickly gain access to the digital asset ecosystem, offers them maximum flexibility to seamlessly integrate their systems and processes, and is highly customizable.

Vision Crypto Cloud combines decades of integration experience, battle-tested technology, and industry-leading liquidity provision to provide an end-to-end solution in one product suite.

Vision Crypto Cloud represents a simple and flexible path for entities to enter the digital asset space which is wrought with challenges for top-tier institutions,” said Nick Hammer. “BlockFills can provide a turnkey, yet scalable software solution with integrated liquidity in the spot, derivatives*, and lending markets to institutions seeking to enter the market or better manage their current digital trading business.”

With Vision Crypto Cloud, institutions can build or scale their digital assets business:

Connectivity: Existing connectivity to numerous market connections, such as banks, custody-technology providers, exchanges, and LPs, with bespoke integrations available.

Expertise: Designed by traditional market veterans with decades of experience trading under the most demanding conditions, Vision Crypto Cloud is the same solution BlockFills runs for its own business each and every day.

Vision Core OMS:

Account Operations: Manage orders, executions, and enter voice deals on the client’s behalf. View and manage cash and margin positions with real-time MTM values across individual assets or in aggregate

Reporting Functions: Generate execution reports based on client, position, asset, timeframe, and more – or any combination thereof

Visibility: Instant, 360-degree visibility across entire network of counterparties

Balances: Real-time comparison of internal ledger balances and those reported by counterparties

Vision Trader:

User Interface: Simple, smart, and intuitive UX. Supports market and limit orders and single-click order cancellation

Dual Use: Functions both as a client portal and trading platform

Account Management: View cash and margin positions, credit utilization, and available balances

Available Assets: Trade across asset classes inside a single, effortless UI. Supports both crypto <> crypto and crypto <> fiat trading

As the crypto world prepares for what is sure to be an exciting year, institutional participation in the space is becoming more important than ever. BlockFills realized a gap in the market for the proper infrastructure and SaaS offerings required by institutional clients looking to offer crypto services to their end-users. By offering both Phoenix and Vision Crypto Cloud, BlockFills provides simple, yet sophisticated solutions based on our client’s needs. Completely customizable and available for white labeling, the BlockFills SaaS Suite delivers premium trading experiences to institutions looking to enter the digital assets space.

*Derivative Products available to Qualified Counterparties Only. For US Persons, client is an Eligible Contract Participant (“ECP”) as defined in Section 1a(18) of the Commodity Exchange Act and related guidance. Non-US Persons must qualify as an Eligible Professional Client. The information in this email is not to be construed as an offer to sell or a solicitation or an offer to buy contracts for difference (CFD), cryptocurrencies, futures, foreign exchange, or options on the aforementioned. All information contained herein is believed to be accurate, Reliz Ltd makes no representation as to the accuracy or completeness of any data, statistics, studies, or opinions expressed and it should not be relied upon as such. The risks of trading can be substantial. Each investor must consider whether this is a suitable investment. Before trading one should be aware that with potential profits there is also potential for losses that may be very large. Contracts for difference (CFD), cryptocurrencies, futures, foreign exchange, and options trading is highly speculative in nature and involves substantial risk of loss and is not appropriate for all investors. Those acting on this information are responsible for their own actions. Past performance is not indicative of future results.